I.B.E.W. Local 86 Annual Family Picnic at Seabreeze

Just a reminder that the last day to purchase tickets for Seabreeze is Tuesday, July 30th!

Please remember to stop by the Hall to purchase tickets for the I.B.E.W. Local 86 Annual Family Picnic at Seabreeze. The picnic will be held Saturday, August 3rd, 2024. The last day to purchase your tickets is Tuesday, July 30th. You must come to the hall to purchase your tickets in person! We accept check, cash or credit/debit card for payment!

I.B.E.W. Local 86 Mixed Clambake

Come join us for the Annual I.B.E.W., Local 86 Mixed Clambake Saturday, September 7th, 2024. Registration is from noon to 2:00 p.m. You can either send in your request for you tickets or stop by the Hall to purchase your tickets. We accept, cash, check or credit/debit card for payment. Tickets must be purchased no later than Friday, August 30th, 2024.

I.B.E.W. Local 86 Annual Family Picnic at Seabreeze

Please remember to stop by the Hall to purchase tickets for the I.B.E.W. Local 86 Annual Family Picnic at Seabreeze. The picnic will be held Saturday, August 3rd, 2024. The last day to purchase your tickets is Tuesday, July 30th. You must come to the hall to purchase your tickets in person! We accept check, cash or credit/debit card for payment!

2024 ROC Pride Picnic

On behalf of Rainbow Seniors ROC, we would like to invite you to join us at the 2024 ROC Pride Picnic on Sunday July 14 from noon to 6:00p.m. at Genesse Valley Park, Roundhouse area. The Local 86 Women’s Committee will have a booth at the event. Please come out and enjoy!

2024 Labor Day Parade and Picnic – Monday, September 2nd, 2024

UPDATE Pre-Orders for Labor Day T-shirts has ended – but please stop by or call the Hall at 585-235-1510 to place your order if you are planning to participate in the Labor Day Parade. More information regarding the picnic will be forthcoming.

Rochester JATC Summer Class Schedule

Conduit Bending Level 1 – Mitchell

Classes start on Tuesday, June 11th and run through Tuesday, July 23rd at 4:30pm

Please call the JATC at 585-235-5050 to sign up

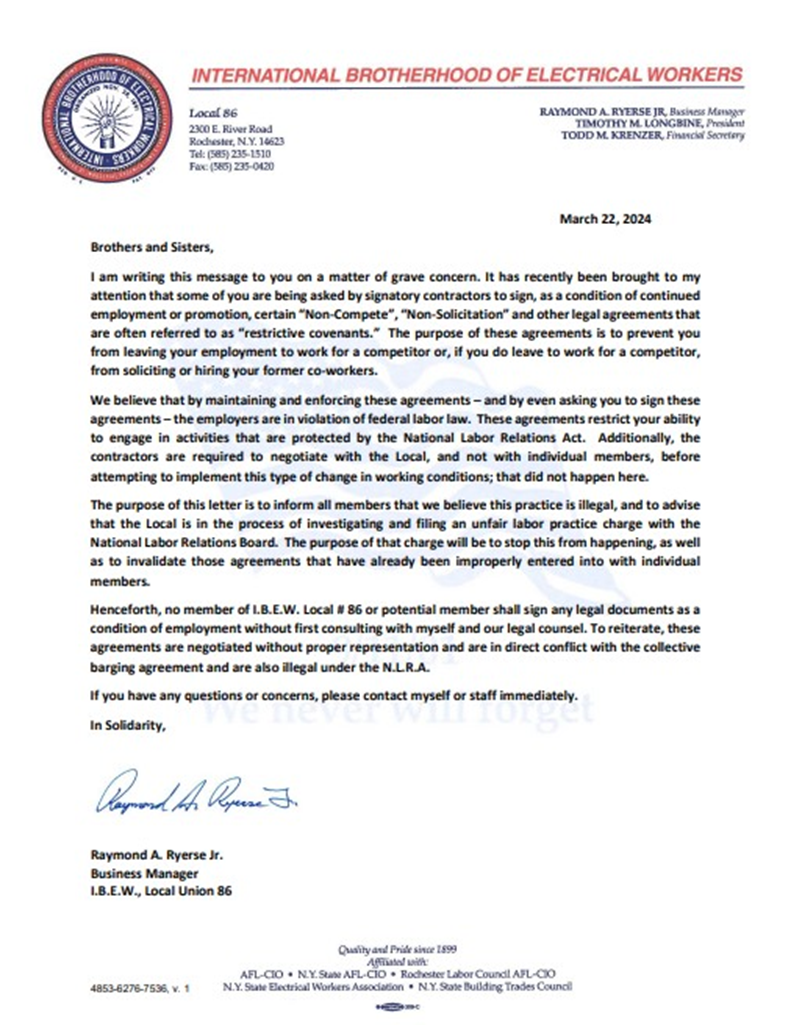

Non-Compete Directive

Rochester Red Wings Tickets

We have purchased season tickets to the Red Wings games.

4 packs of tickets are available at the Hall and are in section 122. Tickets are available first come first served. Please see the link below for the Red Wings Website for the 2024 schedule. https://www.milb.com/rochester/schedule/2024-03/list

Credit and Debit Cards for Dues and Merchandise

Please note: We are NOW ABLE to accept credit cards at the hall for Dues and Merchandise payments!